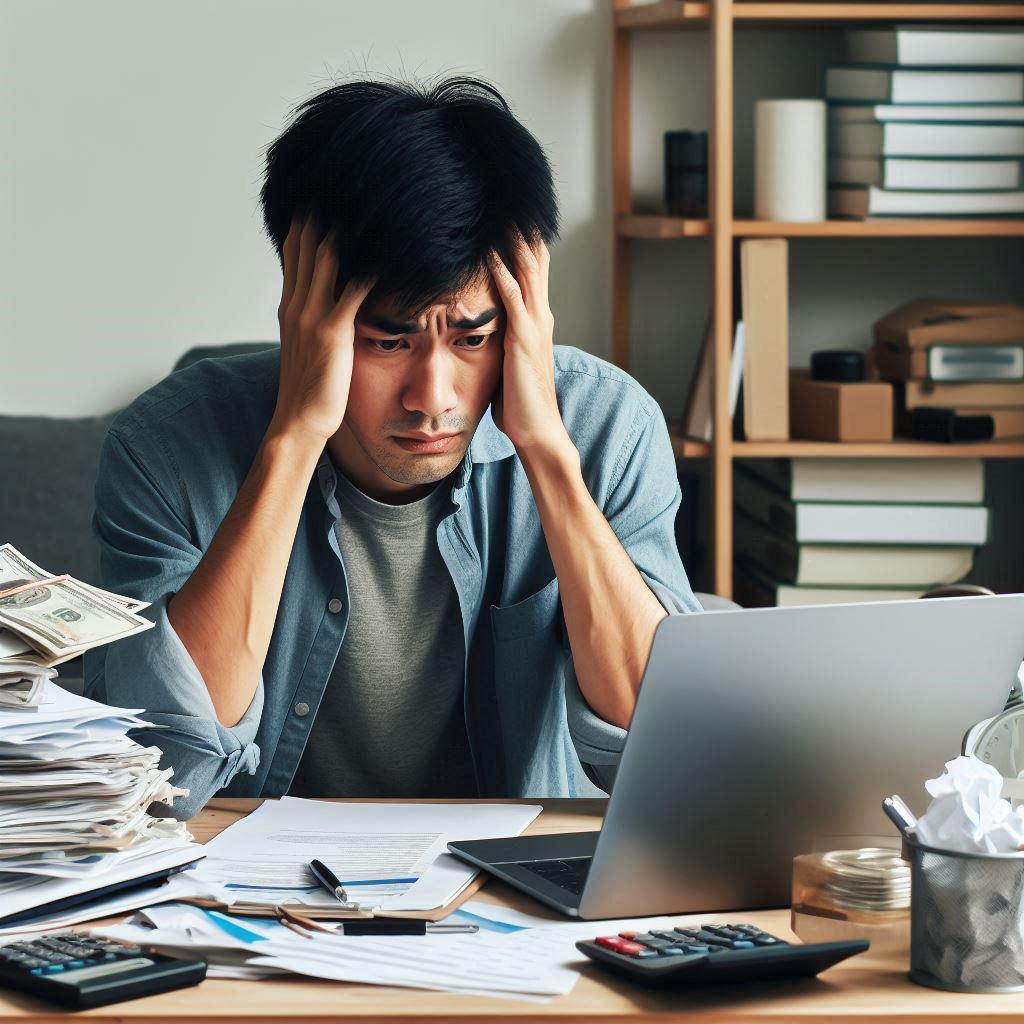

Financial stress is a common issue that can have a significant impact on our mental and emotional well-being. It can lead to feelings of anxiety, depression, and overwhelm, affecting our relationships, productivity, and overall quality of life. Understanding the causes of financial stress and implementing effective coping strategies can help alleviate its burden and promote financial wellness.

Common Causes of Financial Stress

Financial stress can arise from various factors, including:

- Debt: Accumulating debt can be a major source of financial stress. Credit card debt, student loans, and personal loans can create a sense of financial burden and overwhelm.

- Job insecurity: Fear of job loss or financial instability can contribute to financial stress. Economic downturns, layoffs, or changes in employment status can create uncertainty and anxiety about future income.

- Unexpected expenses: Unforeseen events such as medical emergencies, car repairs, or natural disasters can lead to unexpected expenses that can strain your finances.

- Lifestyle inflation: Spending more than you earn can create financial stress. Keeping up with the Joneses or lifestyle inflation can lead to debt and financial instability.

- Lack of financial knowledge: A lack of financial knowledge or understanding can contribute to financial stress. Not knowing how to budget, save, or invest can lead to poor financial decisions and anxiety.

- Relationship conflicts: Financial disagreements or conflicts with partners or family members can create stress and tension.

Coping Strategies for Financial Stress

- Identify the source of stress: Understanding the specific causes of your financial stress can help you address the underlying issues and develop effective coping strategies.

- Create a budget: A budget can help you track your income and expenses, identify areas where you can cut back, and develop a plan to manage your finances more effectively.

- Reduce debt: Develop a plan to reduce your debt by creating a budget, prioritizing payments, and exploring debt consolidation options.

- Increase your income: Consider ways to increase your income, such as seeking a promotion, starting a side hustle, or negotiating a raise.

- Seek professional help: If you’re struggling to manage your finances on your own, consider seeking advice from a financial advisor or credit counselor.

- Practice mindfulness and relaxation techniques: Mindfulness and relaxation techniques can help reduce stress and anxiety. Try meditation, deep breathing exercises, or yoga to manage your emotions.

- Build a support network: Talk to friends, family, or a support group about your financial stress. Sharing your feelings and experiences can provide comfort and support.

- Set realistic financial goals: Set achievable financial goals to give yourself something to work towards. Breaking down large goals into smaller, manageable steps can help you stay motivated and focused.

- Avoid comparison: Don’t compare your financial situation to others. Focus on your own progress and avoid falling into the trap of keeping up with the Joneses.

- Take care of yourself: Prioritize self-care activities that promote physical and emotional well-being, such as exercise, hobbies, and spending time with loved ones.

Financial Wellness and Mental Health

Financial stress can have a significant impact on your mental health. It can lead to feelings of anxiety, depression, and overwhelm, affecting your relationships, productivity, and overall quality of life. Taking care of your mental health is essential for managing financial stress and promoting overall well-being.

Here are some tips for promoting financial wellness and mental health:

- Practice self-compassion: Be kind to yourself and avoid self-blame. Financial setbacks are a normal part of life, and it’s important to treat yourself with compassion and understanding.

- Seek professional help: If you’re struggling with financial stress and anxiety, consider seeking professional help from a therapist or counselor. They can provide support, coping strategies, and guidance.

- Engage in stress-reduction activities: Practice relaxation techniques, such as meditation, deep breathing, or yoga, to reduce stress and anxiety.

- Connect with others: Building social connections and spending time with loved ones can help alleviate stress and provide emotional support.

- Avoid unhealthy coping mechanisms: Avoid unhealthy coping mechanisms, such as excessive spending, substance abuse, or unhealthy eating habits, which can exacerbate financial stress.

- Focus on the present: Avoid dwelling on past mistakes or worrying about the future. Focus on the present moment and take steps to improve your financial situation.

Additional Tips for Managing Financial Stress

- Challenge negative thoughts: Identify and challenge negative thoughts about your finances. Replace negative thoughts with positive affirmations and a growth mindset.

- Set realistic expectations: Don’t expect to solve all your financial problems overnight. Set realistic expectations and celebrate small victories along the way.

- Avoid impulsive spending: Before making a purchase, take some time to think about whether it is necessary and whether you can afford it.

- Learn about personal finance: Educate yourself about personal finance concepts, such as budgeting, saving, and investing. This knowledge can empower you to make informed financial decisions.

- Seek support from others: Don’t be afraid to reach out to friends, family, or a support group for emotional support and encouragement.

Conclusion

Financial stress is a common issue that can have a significant impact on our mental and emotional well-being. By understanding the causes of financial stress and implementing effective coping strategies, we can alleviate its burden and promote financial wellness.

Remember, you’re not alone in facing financial challenges. Seeking support, taking care of yourself, and developing healthy financial habits can help you overcome financial stress and create a brighter future.

Want to take your learning to the next level?

Check out the MyFiLi Online Financial Literacy Course.

With games, quizzes and lessons you will improve confidence with money.

Great for grades 3 and up!

Take advantage of our FREE Trial for Students or Schools / Non Profits.