Build & Grow Your Financial Future.

No credit card or signup required.

Are Financial Worries Holding You Back? 📉

Did you know that many adults…

💸 Lose $1,000+ yearly due to common money mistakes?

🧠 Struggle to answer even basic financial questions?

💳 Face credit card debt over $6,500?

Start Your Financial Journey Today – Absolutely FREE 🎁

Start Your Financial Journey Today – Absolutely FREE 🎁

Transform Your Future: Explore Our Courses 🧭

Transform Your Future: Explore Our Courses 🧭

Choose the path that fits your financial goals, or unlock everything with our comprehensive bundle!

Got Questions? We’ve Got Answers. 💡

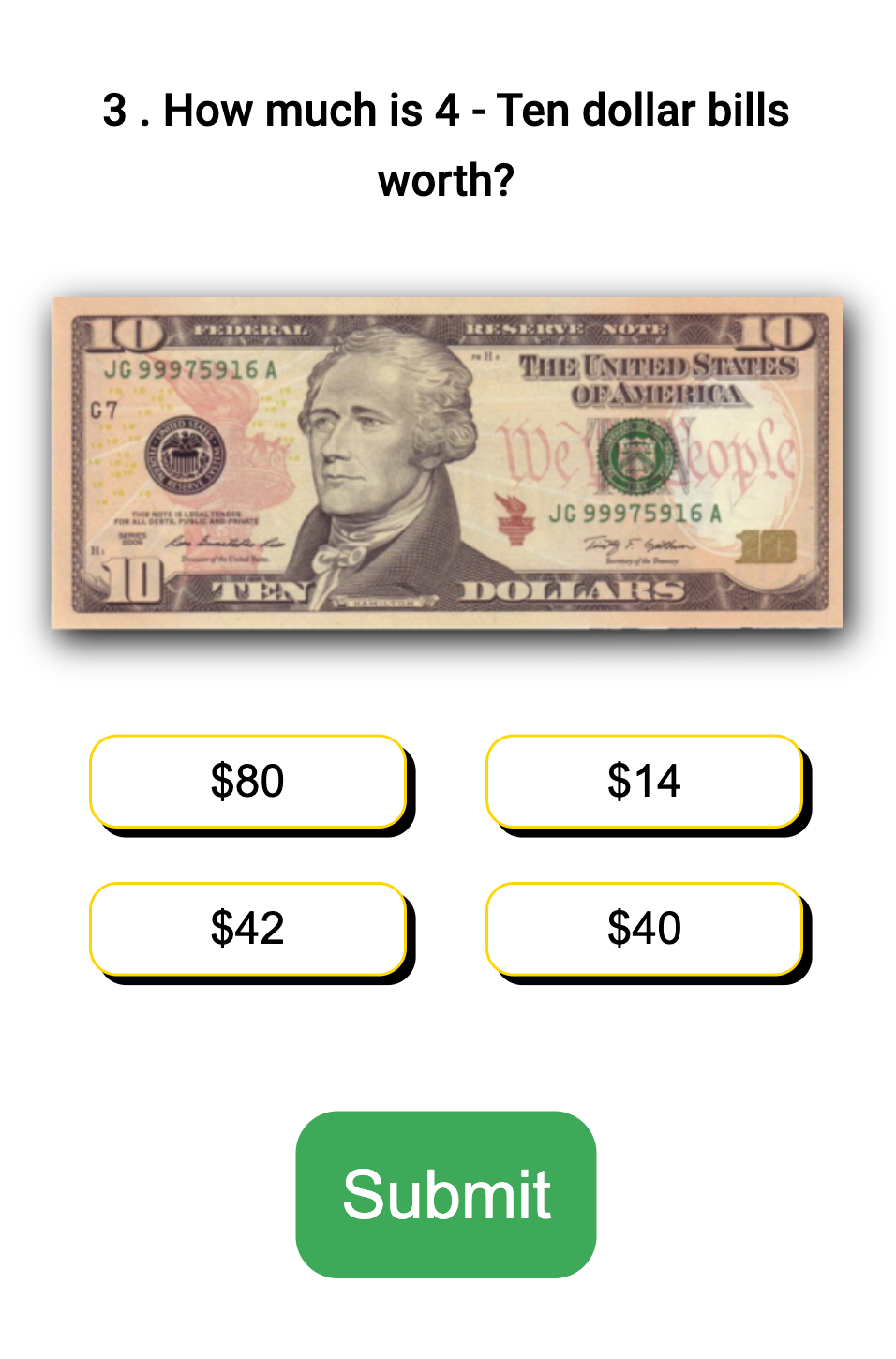

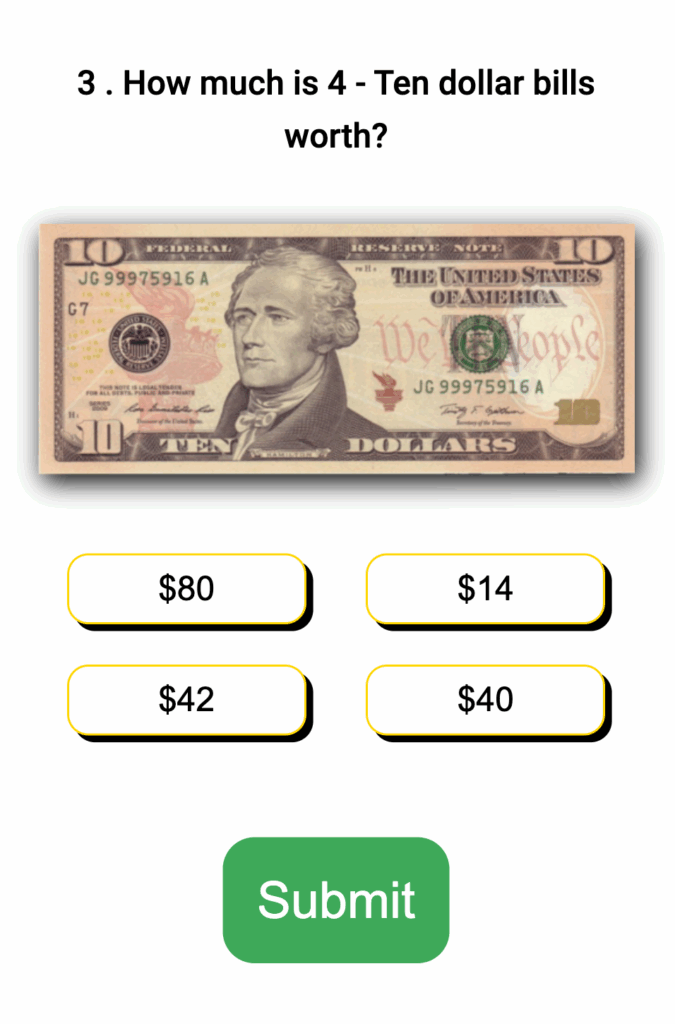

What will I learn in the Financial Literacy Basics course?

In our Financial Literacy Basics course, you’ll gain essential knowledge about managing your money.

You’ll understand the difference between needs and wants, learning how to save effectively, and creating a simple budget.

How will the Digital Safety Basics course benefit me?

Our Digital Safety Basics course equips you with the knowledge and tools to navigate the online world safely and responsibly.

You’ll learn about online privacy, how to identify and avoid scams, and best practices for staying secure on various digital platforms.

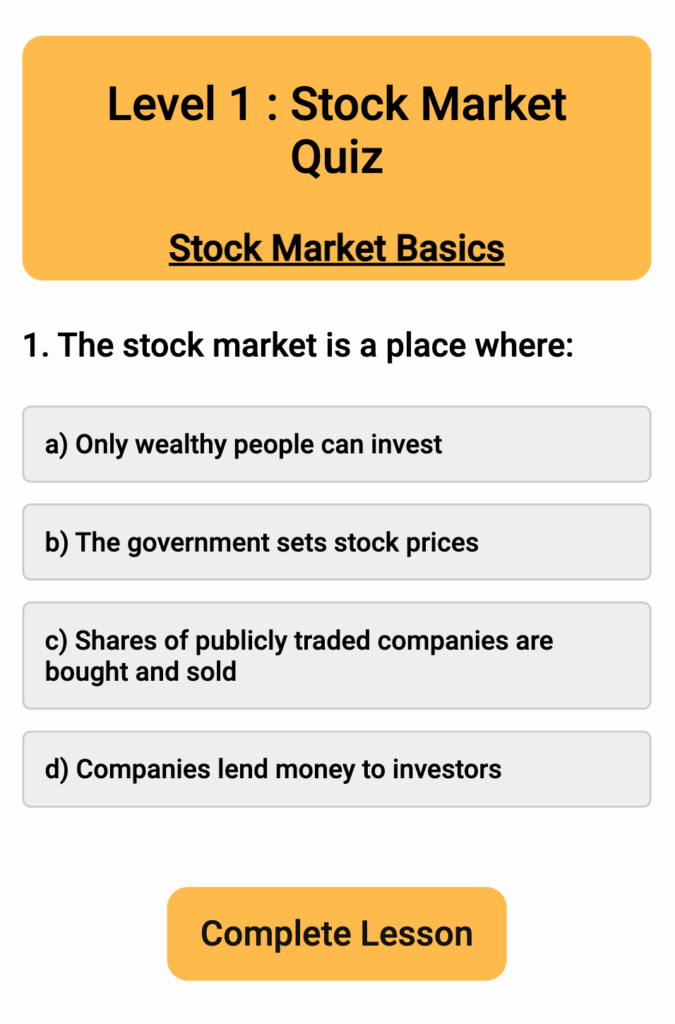

What will I understand after taking the Stock Market Basics course?

The Stock Market Basics course will demystify the world of investing.

You’ll learn fundamental concepts like what stocks and shares are, how the stock market works, and the basics of investing strategies

Will these courses really make me a more financially savvy person?

Absolutely! Our courses are built to provide you with practical knowledge and skills that you can immediately apply to your financial life.

How long do I have access to my courses?

Students recieve lifetime access to the courses they purchase and enroll in.